Budget to Control Your Finances

September 27, 2023

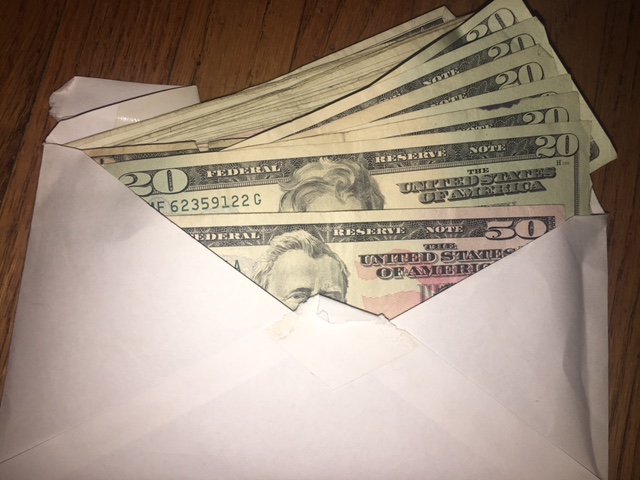

Money management is a crucial life skill that can significantly impact your financial well-being. One of the most effective tools for managing your finances is creating a budget. A well-thought-out budget provides a clear roadmap for your spending, saving, and financial goals. In this blog post, we’ll explore the fundamentals of budgeting and how to create a practical budget that empowers you to take control of your finances.

Why Budgeting Matters

Budgeting is more than just tracking your expenses; it’s about making informed financial decisions that align with your goals. Here are some compelling reasons why budgeting is essential:

- Financial Awareness: A budget helps you understand where your money goes. It sheds light on your spending habits and allows you to identify areas where you can cut back or reallocate funds.

- Goal Achievement: Whether you’re saving for a vacation, a down payment on a house, or retirement, a budget is your roadmap to reaching those financial goals.

- Emergency Preparedness: A budget ensures you have an emergency fund to cover unexpected expenses, reducing the need to rely on credit cards or loans.

- Debt Management: If you have debts, a budget helps you allocate extra funds to pay them down faster, potentially saving you money on interest.

- Reducing Financial Stress: Knowing that you have a plan in place to cover your expenses can reduce financial anxiety and stress.

Steps to Create a Practical Budget

Creating a budget can seem daunting, but it doesn’t have to be complicated. Here’s a step-by-step guide to help you create a practical budget:

1. Set Clear Financial Goals:

Before you start budgeting, define your short-term and long-term financial goals. These goals will guide your budgeting decisions. Whether it’s paying off debt, saving for a vacation, or building an emergency fund, having specific goals in mind gives your budget purpose.

2. Calculate Your Income:

Determine your total monthly income, including your salary, freelance income, rental income, or any other sources of income. Be sure to use your net income (after taxes) for accuracy.

3. Track Your Expenses:

Record all your monthly expenses. Categorize them into fixed expenses (e.g., rent/mortgage, utilities, insurance) and variable expenses (e.g., groceries, dining out, entertainment). Use bank statements, receipts, or budgeting apps to track your spending.

4. Differentiate Between Needs and Wants:

Review your expenses and categorize them as needs (essential expenses like housing, utilities, groceries) and wants (non-essential expenses like dining out, entertainment, impulse purchases). This step helps identify areas where you can cut back if needed.

5. Create Your Budget:

Now, it’s time to create your budget. Start by deducting your total monthly expenses from your monthly income. The goal is to have a surplus, meaning your income exceeds your expenses. If you have a deficit, consider reevaluating your expenses and finding ways to reduce them.

6. Allocate Funds to Categories:

Allocate your surplus funds to different categories based on your financial goals. Prioritize essential categories like savings, debt repayment, and emergency funds. Then, allocate funds for your non-essential expenses, making sure they fit within your budget.

7. Be Realistic:

While budgeting, it’s essential to set realistic expectations. Don’t cut out all discretionary spending, as it can lead to budget burnout. Instead, aim for a balanced budget that allows you to enjoy life while working toward your financial goals.

8. Monitor and Adjust:

A budget is a dynamic tool that should be reviewed regularly. Track your actual spending against your budgeted amounts each month. If you overspend in one category, adjust by reducing spending in another to maintain your overall budget balance.

9. Build an Emergency Fund:

Financial emergencies can happen to anyone. Allocate a portion of your budget to building or replenishing an emergency fund. Experts often recommend saving three to six months’ worth of living expenses.

10. Pay Down Debt:

If you have high-interest debts, allocate extra funds from your budget to pay them down faster. Reducing your debt load can free up more money for savings and investments.

Tips for Successful Budgeting

To make your budgeting journey more effective and less stressful, consider these tips:

1. Use Technology: Take advantage of budgeting apps and online tools. They can automate tracking expenses, setting goals, and monitoring progress.

2. Be Flexible: Life is unpredictable. Your budget should be flexible enough to accommodate unexpected expenses or changes in income.

3. Prioritize Savings: Treat your savings as a non-negotiable expense. Pay yourself first by allocating funds to savings as soon as you receive your income.

4. Involve Your Partner: If you share finances with a partner, involve them in the budgeting process. Collaborate on financial goals and regularly discuss your progress.

5. Avoid Impulse Spending: Implement a waiting period for non-essential purchases. If you still want the item after a set period (e.g., 24 hours), you can consider it.

6. Seek Professional Help: If you’re struggling with debt or complex financial situations, consider consulting a financial advisor or credit counselor for guidance.

Conclusion

Budgeting is a powerful tool that empowers you to take control of your finances, achieve your financial goals, and reduce financial stress with the help of the best credit repair services. It’s not about restriction; it’s about making informed choices that align with your priorities. By following the steps outlined in this blog post and maintaining discipline, you can create a practical budget that sets you on the path to financial success. Remember that budgeting is a skill that improves over time, so be patient with yourself and stay committed to your financial goals.

Recent Comments